April 10, 2021

Hello Everyone,

The stock markets continue to rise over the last month with the Value sector leading the way. The energy, financial, airlines, cruise ship sector and more have followed right along the last few months as well. Over the short term the Value sector still looks good going forward with the recovery of the economy and the realization that the Covid 19 virus will soon subside. I still like the growth sector involving technology over the longer term, but the sector that should outperform shorter term as the economy is recovering is the value sector. On the Bartometer at the end of last year I thought the S&P 500 would hit 4200-4400. As of Friday the S&P was 4094. My AIQ Trading Expert and my other technical computer algorithms are still at a BUY-HOLD signal. Remember that this market is very overvalued and is selling at 24 times earnings, and is currently 21% overvalued based on earnings and interest rates.. Earnings growth has to be great for this market to continue higher.

Interest rates have climbed to the 1.7% level on the 10-year government bond. Bonds, in general, have fallen this year from 0-to 13%, with Floating rate bonds actually rising 2% in 2021. Floating rate bonds and variable interest rate bonds both pay a higher rate as interest rates rise. The interest rate rise over the short term should be more subdued based on Federal Chairman Reserve Powell’s testimony that he is dovish on interest rate rises. I believe over the longer term with the deficit continuing to rise that the market will push interest rates higher. I also believe that inflationary pressures will also push the need for interest rates to rise over the next year or two. Allocations for bonds in your portfolio should be more concentrated in shorter duration, and in the floating rate bond sector/ Treasury inflation-protected Strips or TIPS. Please call me to strategize your portfolio holistically.

Some of the INDEXES of the markets both equities and interest rates are below. The source is Morningstar.com up until April 09, 2021.

Dow Jones +10.97%

S&P 500 +10.0%

EQUAL WEIGHTED S&P 500 +14%

NASDAQ Aggressive growth +7.58%

Large Cap Value +9.68%

I Shares Russell 2000 ETF (IWM) Small cap +13.34%

Midcap stock funds +14.0%

International Index (MSCI – EAFE ex USA +9%

International Emerging Markets +3.6%

Financial stocks +13%

Energy stocks +28%

Healthcare Stocks +.9% Moderate Mutual Fund Investment Grade Bonds (AAA) Long duration +5.1%

High Yield Merrill Lynch High Yield Index +1.4% Floating Rate Bond Funds +1.7%

Short Term Bond +.0%

Multi sector bond funds +.3% Gold -8.43% Long Term 20 year Bond fund -12% 10 year Bond Yield 1.62%

Classicalprinciples.com and Robert Genetskis Excerpts

Market Outlook

Stocks turned in a mixed performance this past week. The Nasdaq and QQQs had the biggest gains while the S&P500 and Dow rose to new all-time highs. In contrast, small-cap stocks fell ½%. Weekly moves show stocks rotating into and out of different areas, while the overall market trend continues to be positive.

The main force behind the upward move is a highly expansive Fed policy. Monetary stimulus creates a surplus of liquidity for stocks and ignited gains in business activity. This week’s sharp reversal in longer-term interest rates provided another spark for sending prices higher

The Biden Administration tried to discourage investors by proposing more destructive policies. Investors were not discouraged. Cautious statements by some Democrats are viewed as a possible barrier to the more these destructive policy proposals. The Fed continues to add kindling to the inflationary fire and promises it will continue to do so. Although longer-term interest rates moved lower this past week, implied inflation expectations remain high. The implied inflation expectation is currently 2.3%. It is measured by subtracting the inflation-adjusted 10-year T-bond yield from the actual 10-year T-bond yield.

Although core inflation rates remain very low, the bond market expects higher inflation. The market is more reliable. As for stocks, the gains in the S&P500 move the index to 21% above fundamental value.

Stocks are overextended and the risks of a reversal, or at least a leveling off, are rising. In spite of the heightened risks and the likelihood for some temporary setback, ongoing monetary stimulus has the potential to continue to drive stock prices higher.

Stock Valuation: S&P 500 21% Overvalued

Economic Fundamentals: Positive

Monetary Policy; Highly Expansive

.

Source: Classical Principles.com

S & P 500

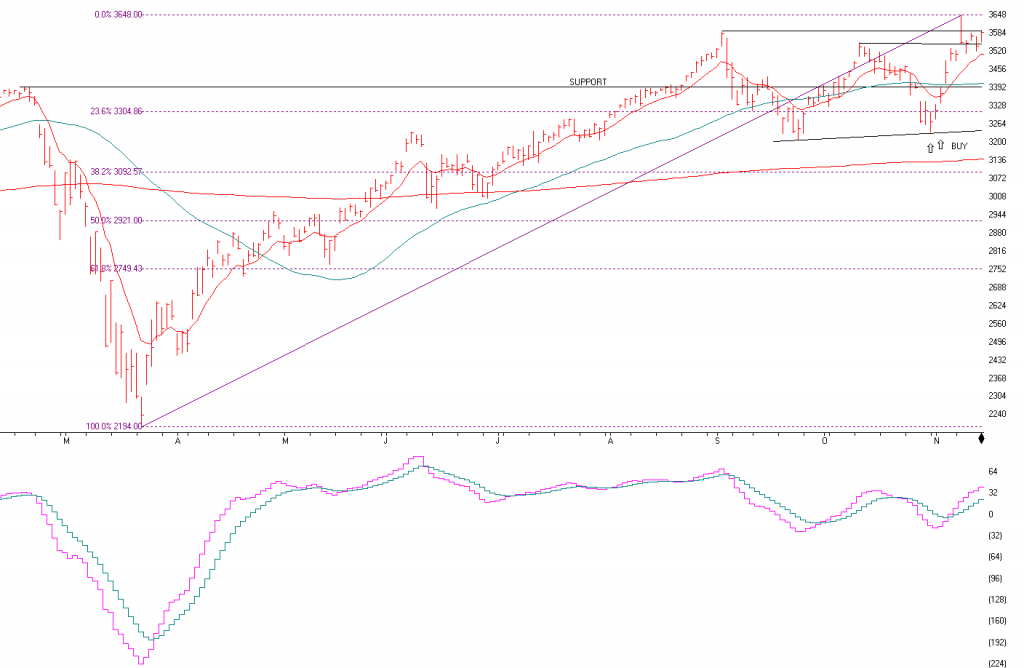

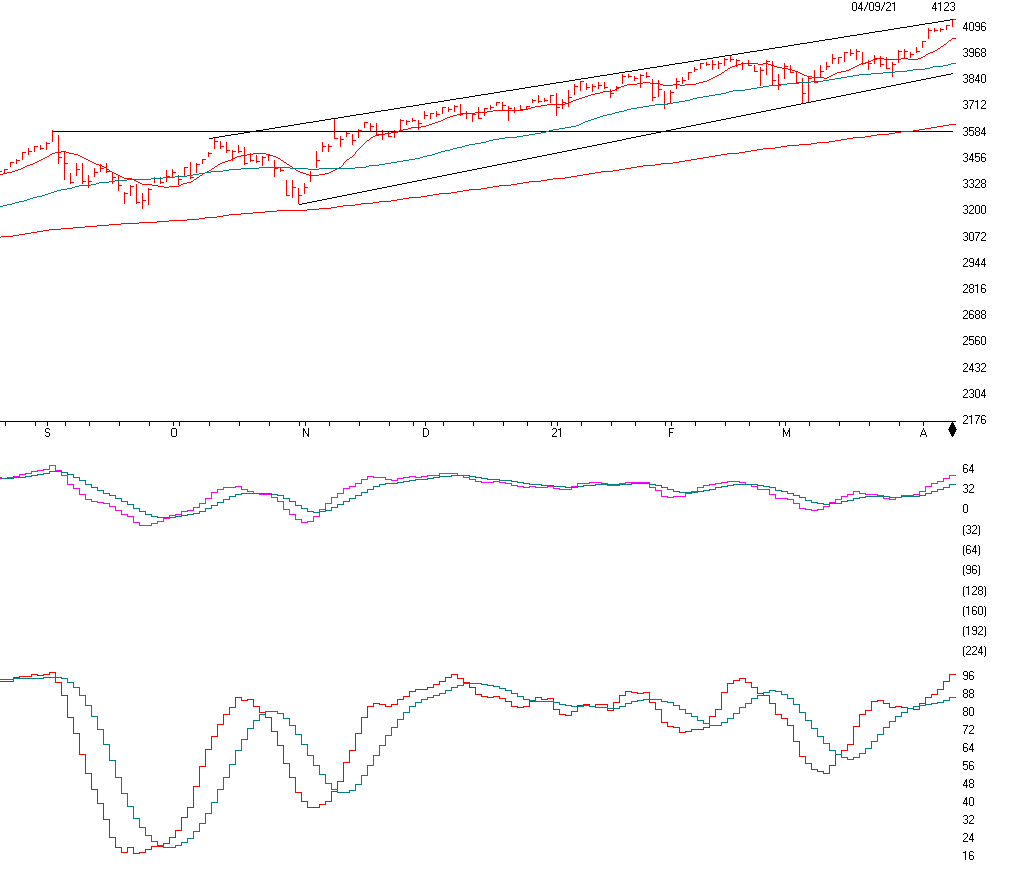

The market weighted S&P 500 which weights the largest companies like Apple, Microsoft, Google and more. This index is up 10% in 2021. 500 of the largest stocks in the USA are in this index. If you look to thchart above you will see an ASCENDING CHANNEL. An ascending channel is Bullish and if it breaks out above the top of the channel it can signal a Continuation of the move higher. Many times the market will top out at the top of the channel, right where it is now. If it breaks down below the channel then it can signal a possible trend change. There is a definite channel trend here HIGHER. But could have a short term setback here.

The indicator below the price chart is the MACD, or momentum indicator has turned to the upside, See the pink line breaking out of the blue line, another Bullish signal

The bottom indicator is SD-SK Stochastics is now above the 88 line and clearing shows an overbought situation in the stock market. Even though the market indicators are BULLISH, and 21% overvalued, we have to be wondering when all of this upside will stop. I thought 4200 to 4400 on the S&P 500. That is a 2-7% move from here. It can go higher than that, we will see. Earnings are coming out and if they show a clear cut blowout in earnings then the market should continue higher, but we have to keep aware of the overvalued nature of the market.

Chart Source: AIQsystems.com

Support levels

S&P 500 4040, 3919, 3870, 3655.

NASDAQ 13,611, 13,472, 13012.

Dow Jones 33280, 29280

These may be safer areas to get into the equity markets on support levels slowly on the accumulation areas.

THE BOTTOM LINE:

The market continues to look ok albeit very overvalued based on earnings and interest rates. I still think the market could reach my 4200-4400 or higher before the end of the year or higher and the economy should be higher than where we are today. I am worried that interest rates over the next year or so will be higher than 2% on the ten-year bond. Markets usually have a more serious correction if the 10-year bond goes above 2.75% to 3%. We are far from that point. I still like Value stocks for the short term and growth for the mid to long term as growth stocks is where the real growth in the economy should be. The NASDAQ stocks have underperformed for the year but, if you are longer-term investors then have a mix of growth and Value stocks or funds. I have been suggesting a higher percentage of small and midcap value and growth funds over the last 5 months and now the smaller stocks are overvalued and a reduction of smaller stocks may be in order. In addition, the Price to Earnings in the market is over 24 times earnings, this indicates a much-overvalued market. If you are within a year of retirement you may want to take some profits if you made money and wait for a better entry. It all depends on your goals and risk tolerance.

Best to all of you,

Joe Bartosiewicz, CFP®

Investment Advisor Representative

Securities and advisory services offered through SagePoint Financial, Inc. (SPF), member FINRA/SIPC. SPF is separately owned and other entities and/or marketing names, products or services referenced here are independent of SPF. 800-552-3319 20 East Thomas Road Ste 2000 Phoenix AZ 85012

If you have any questions, please call me at 860-940-7020.

Joe Bartosiewicz, CFP®

92 High Street

Thomaston, CT 06787 and

7501 East MCDowell RD #2172 Scottsdale, AZ 85257

Disclaimer: The views expressed are not necessarily the view of Sage Point Financial, Inc. and should not be interpreted directly or indirectly as an offer to buy or sell any securities mentioned herein. Securities and Advisory services offered through Sage Point Financial Inc., Member FINRA/SIPC, an SEC-registered investment advisor.

Past performance cannot guarantee future results. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Please note that individual situations can vary. Therefore, the information presented in this letter should only be relied upon when coordinated with individual professional advice. *There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss in periods of declining values.

It is our goal to help investors by identifying changing market conditions. However, investors should be aware that no investment advisor can accurately predict all of the changes that may occur in the market.

The price of commodities is subject to substantial price fluctuations of short periods and may be affected by unpredictable international monetary and political policies. The market for commodities is widely unregulated, and concentrated investing may lead to Sector investing may involve a greater degree of risk than investments with broader diversification.

Indexes cannot be invested indirectly, are unmanaged, and do not incur management fees, costs, and expenses.

Dow Jones Industrial Average: A weighted price average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ.

S&P 500: The S&P 500 is an unmanaged indexed comprised of 500 widely held securities considered to be representative of the stock market in general.

NASDAQ: the NASDAQ Composite Index is an unmanaged, market-weighted index of all over the counter common stocks traded on the National Association of Securities Dealers Automated Quotation System

(IWM) I Shares Russell 2000 ETF: Which tracks the Russell 2000 index: which measures the performance of the small capitalization sector of the U.S. equity market.

A Moderate Mutual Fund risk mutual has approximately 50-70% of its portfolio in different equities, from growth, income stocks, international and emerging markets stocks to 30-50% of its portfolio in different categories of bonds and cash. It seeks capital appreciation with a low to moderate level of current income.

The Merrill Lynch High Yield Master Index: A broad-based measure of the performance of non-investment grade US Bonds

MSCI EAFE: the MSCI EAFE Index (Morgan Stanley Capital International Europe, Australia, and Far East Index) is a widely recognized benchmark of non-US markets. It is an unmanaged index composed of a sample of companies’ representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends.

Investment grade bond index: The S&P 500 Investment-grade corporate bond index, a sub-index of the S&P 500 Bond Index, seeks to measure the performance of the US corporate debt issued by constituents in the S&P 500 with an investment-grade rating. The S&P 500 Bond index is designed to be a corporate-bond counterpart to the S&P 500, which is widely regarded as the best single gauge of large-cap US equities.

Floating Rate Bond Index is a rule-based, market-value weighted index engineered to measure the performance and characteristics of floating-rate coupon U.S. Treasuries, which have a maturity greater than 12 months.